Where the Oil Tanks Used to Be

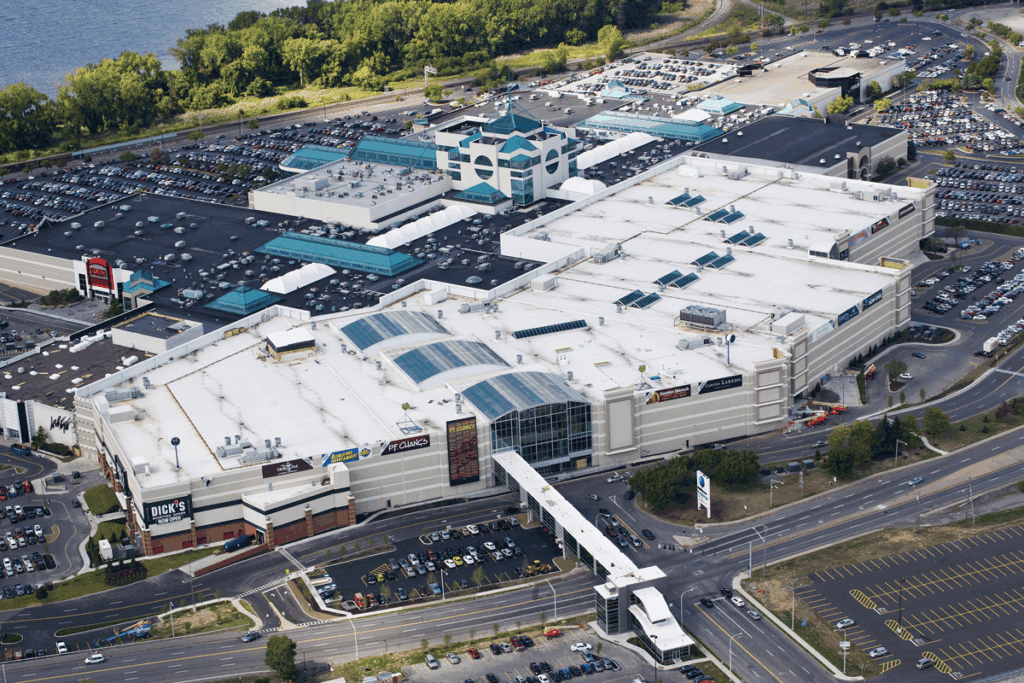

At first glance, the six-story mass of Destiny USA feels out of place along the edge of Onondaga Lake.

Beneath its concrete weight, the ground still remembers what it used to be - a scrapyard boxed in by rusted tanks and stained soil.

Before the glass doors and marble tile, this was Oil City. In 1987, The Pyramid Companies pitched something bigger: retail, where piles of steel and industrial runoff sat for decades.

Critics doubted the vision, and others outright fought it. But by October 15, 1990, Carousel Center opened with fanfare and a carousel on its second floor.

Visitors today still pass through escalator wells and layered atriums carved from those early blueprints. But the mall carries a memory, one stitched into old warehouse trusses and parking decks.

On its busiest days, it remains one of the most visited places in Syracuse and quietly anchors one of the main things to do in Syracuse, New York.

How Destiny USA Broke Ground in a City That Resisted

The plot of land where Destiny USA stands was once known as Marley Scrap Yard.

Surrounded by oil tanks and facing Onondaga Lake, the site became the target of redevelopment when The Pyramid Companies released plans in July 1987 for a retail complex that would span 1,000,000 square feet.

At the time, it was one of the boldest commercial proposals in upstate New York.

Resistance came quickly. Downtown retailers saw the project as a threat. Developers Wilmorite Corp. and Eagan Real Estate Inc. publicly challenged its construction.

Wilmorite was working on Great Northern Mall in Clay, while Eagan, already managing malls nearby, projected a 25 percent drop in downtown sales.

Both firms pushed back using lobbying groups and alternative mall proposals. One group, the "Citizen's League for an Environmentally Acceptable Northeast," was reportedly linked to Wilmorite's out-of-state allies.

The site itself complicated things. As a brownfield filled with industrial debris, it required heavy cleanup.

Despite that, The Pyramid Companies pushed forward. By 1990, excavation gave way to a steel frame. Carousel Center opened on October 15 that year.

The carousel, a 1908 model from Philadelphia Toboggan Coasters, gave the mall its original name and softened the space's industrial origin.

Retail Mix and Market Response - Carousel Center in the 1990s

When Carousel Center opened in 1990, its tenant list blended familiar department store brands with a few bets on trend. Bonwit Teller, Kaufmann's, Hills, Lechmere, Chappell's, Steinbach, and JCPenney filled anchor slots.

Inside, shoppers could descend into the Commons level, which offered junior anchors like The Rx Place and Filene's Basement.

That lower level also housed underground parking and later became home to offbeat retailers such as Nobody Beats the Wiz.

During the first half of the decade, some names shifted. Chappell's became The Bon Ton in 1992 after a corporate merger.

In 1994, construction wrapped on a new space for Lord & Taylor, bringing another national chain into the fold. Still, one proposal lagged.

Carousel Landing, a retail strip to be built just beyond the mall, remained stalled due to environmental reviews. By 1996, Pyramid secured approval to condemn the tank sites for future development.

Meanwhile, Pyramid pivoted. In 1997, a plan to double the mall's size replaced Carousel Landing altogether.

The expansion called for 150 stores and three additional anchors. CompUSA, DSW, Best Buy, and Bally Total Fitness arrived between 1998 and 1999.

Hills transitioned to Ames in 1999 after the acquisition. The 1990s closed with more square footage in motion.

Rebranding and the Destiny USA Pivot - Development in the 2000s

In March 2000, Bonwit Teller closed its Carousel Center store. That same space was quickly converted into the first U.S. mall location for H&M. Retail turnover wasn't the only activity.

That year, Kaufmann's Furniture Galleries opened a new showroom, and Pyramid began floating plans that stretched beyond a traditional expansion.

By 2001, those ideas took clearer shape: a triple-sized mall branded as "Destiny USA."

Plans included a central visitor center, expanded entertainment zones, and a new administrative core that replaced the Skydeck event space.

But the project wasn't universally embraced. Public funding requests and hefty tax breaks drew criticism.

Some questioned whether the mall could evolve fast enough to justify its scale. Others worried about retail oversaturation.

Circuit City moved in by 2004, taking over DSW's earlier footprint. DSW itself relocated to the Commons Level. Circuit City would shutter by 2009 following its corporate collapse.

Sports Authority filled the anchor space in 2005. A year later, Kaufmann's rebranded as Macy's after a national consolidation by its parent company.

By 2007, Pyramid announced Phase One of Destiny USA: an 800,000-square-foot addition. It aimed to be powered entirely by renewable energy.

The mall's status as a traditional retail center was shifting, with Pyramid placing bigger bets on scale, branding, and concept retail.

Leasing, Launches, and the Full Rebrand - Destiny USA in the 2010s

In May 2011, a financing agreement between Citigroup and The Pyramid Companies cleared the way for construction to resume.

The long-awaited addition took shape with a new mix of luxury retailers, entertainment venues, and outlet concepts.

Early marketing leaned into the word "destination" while the floorplates started absorbing holiday vendors ahead of permanent tenants.

By November 2011, Destiny USA claimed the title of New York's largest mall. It stood as the sixth largest in the country by square footage.

Online, CarouselCenter.com redirected users to DestinyUSA.com. By August 2012, signage had changed, and the rebranding was official.

The carousel remained, but references to its name were phased out across media and property material.

Retailers followed the new footprint. Burlington Coat Factory moved into the Commons Level. Dick's Sporting Goods opened along with chains like P.F. Chang's.

New concepts arrived, too: WonderWorks, Dave & Buster's, APEX Entertainment, RPM Raceway, and Canyon Climb - the last billed as the largest indoor ropes course globally.

Regal Cinemas launched its IMAX and RPX theaters on June 14, 2013, with a 3D screening of Man of Steel.

In the fall of 2015, Nordstrom Rack added 33,000 square feet to the first level. By 2017, Embassy Suites completed a seven-story, 209-room hotel attached to the property.

Closures, Bankruptcy Fallout, and Mall Resets - 2016 to 2021

Between 2016 and 2020, Destiny USA cycled through more large-format changes. When Sports Authority declared bankruptcy in 2016, At Home replaced it as an anchor tenant.

The company, a home décor chain, moved in with an emphasis on open layouts and wide-aisle merchandising.

In October 2019, LEGO opened a branded retail space, aiming to anchor family traffic.

The arrival of 2020 changed things. JCPenney announced plans to close its Destiny USA location in June, citing national restructuring.

In August, Lord & Taylor exited the mall after filing for bankruptcy and liquidating all brick-and-mortar locations.

These two closures bookended a rough fiscal stretch shaped by the global health crisis, which disrupted foot traffic and delayed new leasing deals.

In 2021, the property tried to pivot back. Regal Cinemas unveiled its new 4DX theater format, part of an upgrade to the existing cinema complex.

Around the same time, Get Air Trampoline Park announced its arrival inside the mall. Developers leaned into activity-based tenants as a way to diversify from traditional retail.

Leasing picked up again by late 2021, though some square footage remained unclaimed.

Security Strategy, Surveillance, and Public Policy - Crime Response from 2021 Onward

Starting in early 2021, Destiny USA began shifting more attention toward internal safety. On January 23, a 14-year-old was stabbed outside one of the parking decks.

Two weeks later, mall operators expanded their parental escort policy. Instead of applying only on weekends after 4 pm, it is now required that minors be accompanied by adults at all times.

That same month, space was given to the Syracuse Police Department on the fifth floor to build a larger operations area.

By December 20, 2021, another incident, an incident involving weapon use in the upper parking lot, renewed public scrutiny.

In February 2022, a weapon was fired inside a restroom during an attempted robbery. Afterward, Destiny USA hired more uniformed SPD officers to supplement its security staff.

Probation officers were added shortly after, with a focus on monitoring restricted individuals.

The volume of calls escalated. From January through June 13, 2023, SPD logged 706 calls from the property.

Larceny topped the list at 147, followed by calls about domestic disturbances and burglary. According to police, call volume exceeded that of 2020, 2021, and 2022 by nearly 200.

In August 2023, Destiny USA installed Flock Safety cameras at each vehicular entry, flagging license plates linked to criminal alerts.

Retail Churn, Temporary Leases, and Market Experiments - 2023 to Mid-2025

By early 2023, Destiny USA had settled into a cycle of turnover. Longtime names like Banana Republic and Sephora pulled out between May and June.

In September, Newbury Comics confirmed it would open a location at the mall the following month. Dry Goods USA followed, opening in October 2023 on the second level.

Other arrivals around that time included Hobby Lobby, Lovisa, and Earthbound Trading Co.

Departures kept pace. Forever 21 announced in February 2024 that its last day would be March 31.

A month later, the Museum of Intrigue, which had operated for seven years as an interactive storytelling venue, confirmed it would close by the end of April.

On May 7, 2024, the mall reported that At Home would exit by August. That same fall, TGI Fridays left the mall, as did Nordstrom Rack, which officially shuttered on February 1, 2025.

Food and entertainment tried to fill some of the gaps. Wetzel's Pretzels opened on May 16, 2025. Mystery Bins, a retailer known for repackaged Amazon returns and closeouts, scheduled its opening for July 1 in the former JCPenney space.

These newer tenants reflected a shift toward lower-cost, quick-turn inventory formats and discount-focused operators.

🍀

I see the mall as needing more entertainment attractions. Indoor water park where sports authority was. Think out of the box. Attract stores that no one has in this area that is unique.

Malls that thrive now usually do so by becoming something else entirely. Your comment sketches a blueprint for how Destiny could follow suit.